Debt Day: When The EU27 Run Out Of Money

Debt Day: When The EU27 Run Out Of Money

8 December 2023

On 8 December 2023, the European Union (EU) will reach Debt Day, according to a study by the Spanish think tank, Instituto Juan de Mariana. This date signifies when the average EU country will exhaust its tax revenues and will have to turn to public debt to fund its remaining government expenditures.

What long-term impact did the COVID-19 pandemic have on public debt levels? The 2023 edition of the Debt Day report finds that from Q4 2019 to Q1 2023, public debt rose 15 percentage points of the GDP in France (+15 pp) and Spain (+14.6 pp) — the worst-performing countries during this period. Across the EU, the average increase was 6 percentage points of the GDP, although seven nations successfully reduced their government financial obligations.

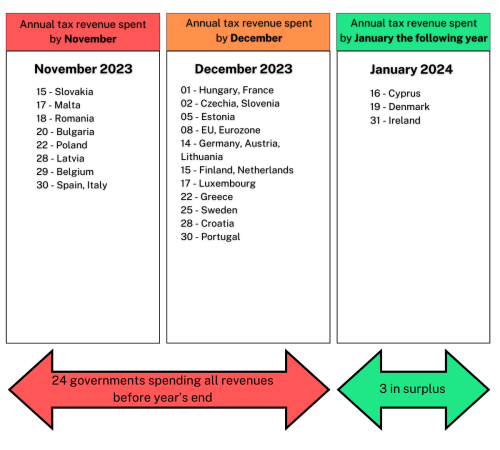

In 2023, tax revenues covered 93.6 per cent of all government expenditures across the EU. However, it is important to note that, by the end of 2023, three countries (Cyprus, Denmark, and Ireland) will be able to reach a fiscal surplus. Further, four other EU member states (Greece, Sweden, Croatia, and Portugal) will manage to cover more than 97 per cent of their expenses through tax revenues.

Slovakia has emerged as this year’s worst-performing country with its fiscal outlook projected to cover only 318 days of public expenses via tax revenues, relying on additional government debt for the remaining disbursements.

An accessible approach to government finance

In 2023, only 3 out of the 27 EU member states are projected to achieve a budget surplus. Ideally, this scenario should spark a widespread discussion about the sustainability of current spending patterns. However, this crucial topic often takes a back seat, possibly because such discussions involve complex economic metrics such as debt-to-GDP ratios, making them challenging for the average citizen to grasp.

To bridge this gap, the Institut Economique Molinari, a French think tank affiliated with Epicenter, originally introduced its groundbreaking Credit Day report. This innovative study delves into government revenues and expenditures, presenting them in a more comprehensible manner. By assessing the extent to which public administrations can finance their spending through taxation, the report forecasts each country’s fiscal deficit in a familiar, yearly calendar format.

This year, the Instituto Juan de Mariana, a Spanish think tank, brought back Debt Day in its 2023 edition. The study, developed using data from the European Commission’s Autumn Forecast, serves as a useful tool to measure the fiscal profligacy of EU member states by translating the current budget outlook into calendar days.

The EU27’s Debt Day is on 8 December

According to the study, EU’s Debt Day 2023 falls on 8 December if we add up all government revenues and expenses for the current 27 member states of the EU. This means that when we combine all government income across the EU, it covers just 93.6 per cent of all public spending. In other words, 334 days of expenses are covered via taxation and other sources of government income; the remaining 23 days will be financed via deficit.

Back in 2014, this gap was even bigger, at 37 days; therefore, there have been some improvements since in terms of deficit reduction. However, this does not mean that budget surplus has become the norm; aggregate government debt has continued to rise and now amounts to 83.7 per cent of the EU’s GDP, significantly above the recommended threshold of 60 per cent.

Slovakia is the worst-performing country of 2023 in terms of budget stability—its Debt Day arrived

on 15 November. At the other end, we find Ireland, which has managed to fund all its government expenditures via taxation and, in fact, enjoys a budget surplus so large that it can pay for an extra month of expenses without having to resort to debt. Similarly, Denmark (19 January) and Cyprus (16 January) have also managed to reach a solid budget surplus (See Table 1 for details on other countries).

Among the EU’s largest economies, Belgium (29 November), Spain (30 November), Italy (30 November), and France (1 December) rank below the EU average of 8 December; comparatively, Germany (14 December), Netherlands (15 December), and Sweden (25 December) have fared better.

A closer look at Spain’s indebtedness

As the Instituto Juan de Mariana is based in Madrid, the main focus of the report is Spain’s rising public debt. The Mediterranean country’s forecast projects 21 consecutive years without ever reaching a budget surplus (2008–2028). As a result of fiscal irresponsibility, government debt has grown from 40 to 110 per cent of the GDP.

Compliance with Eurozone standards that aim to reduce public debt to 60 per cent of the GDP could significantly boost the Spanish economy. The report estimates that this improvement would increase the GDP output by 4.6 points, adding EUR 62 billion to the economy. Sadly, Spanish PM Pedro Sánchez appears to have embarked on a spending spree, which explains why European Commission officials have recently stated that the country’s fiscal outlook for 2024 is “very complicated” and the country should curtail government expenditure.

In 2023, Spain is expected to cover EUR 60 billion of public expenses via debt, which means that the country’s financial obligations are growing at a pace of EUR 165 million per day, EUR 7 million per hour, EUR 115,000 per minute, and EUR 2,000 per second. This “debt clock” highlights the ever-growing problem of public debt, which can only be stopped by implementing a serious fiscal stability programme.

Although Spain is not the worst-performing country in 2023, the fact is that the seven countries that are better placed than Spain in the same list have an average debt of 53.8 per cent of the GDP, i.e., their current fiscal position is 50 per cent better than that of the Iberian country. Besides, even if we focus on the Club Med countries, we find that Spain’s Debt Day arrives earlier than Malta’s (17 November) and falls on the same day as Italy’s but comes much earlier than that of Greece (22 December), Croatia (28 December), Portugal (30 December), and Cyprus (16 January).

In 2023, Spain is expected to cover EUR 60 billion of public expenses via debt, which means that the country’s financial obligations are growing at a pace of EUR 165 million per day, EUR 7 million per hour, EUR 115,000 per minute, and EUR 2,000 per second. This “debt clock” highlights the ever-growing problem of public debt, which can only be

stopped by implementing a serious fiscal stability programme.

COVID-19 and public finance

The 2023 edition of Debt Day finds that between Q4 2019 and Q1 2023, public debt rose significantly in France (+15 percentage points of GDP) as well as in Spain (+14.6 pp of GDP); they rank as the worst-performing countries for the period covering the COVID-19 crisis. In contrast, the long-term effects of the pandemic on public finance were significantly lesser across the EU, as

the average increase in the debt-to-GDP ratio was 6 percentage points of the GDP. Besides, seven nations successfully managed to reduce their government financial obligations during this period, which shows that there was no trade-off between dealing with a health emergency and keeping the books in order.

References

Marques, N. and Philippe, C. (2017) Le Jour où les Etats de l’Union Européenne ont Dépensé Toutes Leurs Recettes

Annuelles. Bruxelles: Institut Économique Molinari.

Eurostat. (n.d). General government gross debt – annual data. (https://ec.europa.eu/eurostat/web/products-datasets/-

/teina225).

Eurostat. (n.d). General government deficit/surplus. (https://ec.europa.eu/eurostat/web/products-datasets/-/tec00127).

Sánchez de la Cruz, D. and Calvo López, S. (2023). Día de la Deuda 2023. Madrid: Instituto Juan de Mariana.

(https://juandemariana.org/el-ijm/notas-de-prensa/hoy-es-el-dia-de-la-deuda/).

Download or share this publication

View the PDF

EPICENTER publications and contributions from our member think tanks are designed to promote the discussion of economic issues and the role of markets in solving economic and social problems. As with all EPICENTER publications, the views expressed here are those of the author and not EPICENTER or its member think tanks (which have no corporate view).