Sweet Tax Temptation

Sweet Tax Temptation

Matej Bárta and Radovan Ďurana // 7 November 2023

In early October, Slovakia’s interim government unveiled a series of measures aimed at strengthening Slovakia‘s public finances. It included nearly 100 policies, with close to 60 per cent of them relating to tax increases. One of the measures is the implementation of a sugar tax, specifically targeting sugar-sweetened beverages (SSBs). In our report, ‘Sweet tax temptation: The sugar tax will reduce your wallet size, but not your waistline (Ďurana and Bárta 2023),’ we challenge the government´s statement, that ‘there is an urgent need to put in place an effective response to reduce their [obesity and related diseases] prevalence. Among the policy options available that have been proven by practice is the introduction of taxes on sugar-sweetened beverages’.

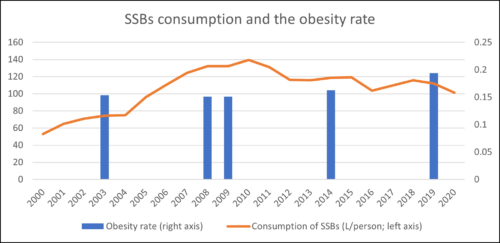

Our report, a timely publication from the Institute of Economic and Social Studies (INESS), offers an analysis of the implementation of similar taxes in other countries. It delves into the current state of affairs in Slovakia, particularly the growing issue of overweight and obesity, accompanied by the continuous drop in the consumption of sugar-sweetened beverages (a trend observed since 2010), as well as sweeteners since 2017. Meanwhile, there has been a noticeable uptick in the consumption of unflavoured and unsweetened beverages, signifying a shift in the dietary preferences of Slovaks. It appears that people are progressively opting for less calorie-dense choices.

These findings cast doubts over the claims made by those advocating for a sugar tax. Despite the declining consumption of sugar and sugar-sweetened beverages, the rates of overweight and obesity continue to rise. This challenges the argument that imposing a sugar tax would result in a healthier population by reducing sugar or SSB intake. The arguments presented in the initial section of the report suggest that this assumption may not effectively translate into reality, or its impact may not be substantial enough.

In Section 3 of the publication, we explore the impact of the sugar tax on sweet beverages, offering a comprehensive meta-analysis of studies that investigate the effects of a sugar-sweetened beverage tax – the very tax under consideration in Slovakia. We scrutinise the potential consequences of such a tax in three distinct phases.

Our analysis indicates that, to begin with, the introduction of a tax would indeed lead to a decrease in the demand for sugar-sweetened beverages. Nonetheless, it is essential to acknowledge the likelihood of negative unintended consequences, such as increased cross-border shopping.

Secondly, we explored the influence of the tax on an individual‘s overall caloric consumption. Though available studies on this specific aspect are relatively limited in number, their conclusions suggest that any reduction in caloric intake would likely be minimal.

Thirdly, we investigated the effects of the tax on overweight and obesity, which we found to be so ambiguous that attempting to draw concrete conclusions about the potential impact of a Slovak tax becomes challenging.

Based on the current scientific evidence at our disposal, we cannot support the assertion that the tax represents an effective solution that has been proven by practice.

Attaining good health is like intricately weaving a delicate web of daily choices, involving nutrition, stress management, physical activity, relationships, and one‘s environmental surroundings. For that reason, a single, isolated intervention, such as implementing a tax on one element of an imbalanced diet, may not help transform individuals’ well-being.

Consequently, there is a looming risk that the sugar tax may pose just another financial burden on consumers without achieving its intended goal. Furthermore, the tax could strengthen the ‘nanny state’, undermining individual responsibility. Even though there exists a formal action plan to combat obesity in Slovakia, a comprehensive strategy to address this issue is lacking. Politicians often fail to link tax revenues to the intended purpose, and the proposed sugar tax appears to address the issue after the fact.

The effectiveness of the tax on sugar-sweetened beverages in addressing obesity is uncertain, as reflected in the existing literature. Further, there is a lack of comprehensive data outlining the underlying causes of obesity in Slovakia, in addition to an absence of additional motivational and educational strategies to tackle this issue. Therefore, we propose that this tax not be adopted in Slovakia.

The publication is available here in Slovak.

EPICENTER publications and contributions from our member think tanks are designed to promote the discussion of economic issues and the role of markets in solving economic and social problems. As with all EPICENTER publications, the views expressed here are those of the author and not EPICENTER or its member think tanks (which have no corporate view).